When Ron Baron was in the early stages of establishing his investment business, he received valuable advice from Steve Wynn, the renowned casino magnate. Wynn suggested that Baron name his investment company after himself, a symbolic commitment to stand firmly behind his clients and customers. Fast forward four decades, and Baron Capital has made a momentous investment in Elon Musk, Inc.

Baron initially injected $570 million into Tesla, primarily between 2014 and 2016, representing roughly 2% of his assets under management at the time. Today, after some share sales, Tesla constitutes approximately 10.9% of Baron Capital's substantial $41 billion under management. This strategic move has propelled Baron's primary mutual fund into the unique position of being the sole mutual fund to outperform the Nasdaq over the past 5, 10, and 15 years, delivering an impressive 17% annualized return during this period.

Baron's investment philosophy underscores the importance of a long-term, focused approach, emphasizing ownership of a select number of companies to accumulate wealth. He is known for maintaining a concentrated portfolio and being a shareholder in one of the top-performing major tech companies, Tesla. Consequently, he earns a spot on The MarketWatch 50 list, which recognizes influential figures in the financial markets.

While Elon Musk recently expressed reservations about Tesla's long-anticipated Cybertruck and consumer affordability in light of high interest rates, Baron remains bullish on Tesla's stock, predicting that its market capitalization could surge from the current $630 billion to as much as $4 trillion over the next decade. According to Baron, Tesla is not just an automaker or a battery company; it's set to become an integral part of the entire automotive industry, dominating with its autonomous driving technology.

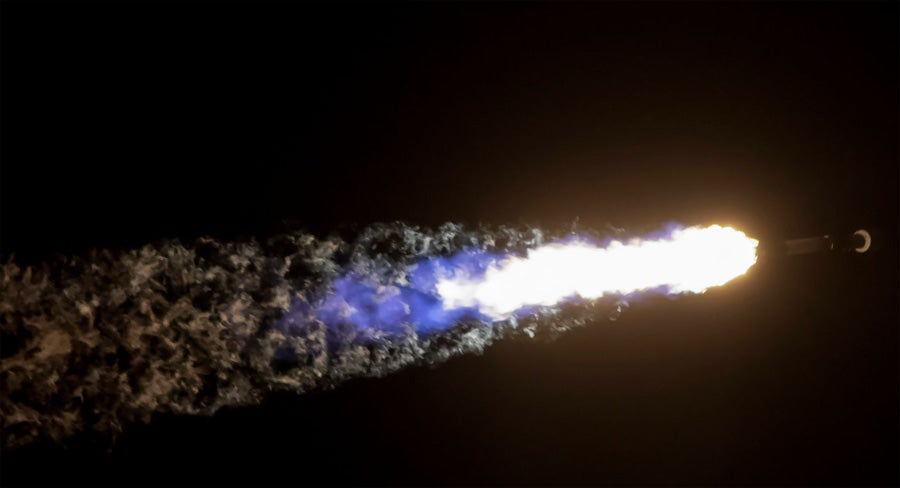

However, Baron's optimism doesn't end with Tesla; he is even more enthusiastic about Space Exploration Technologies Corp., or SpaceX. Although SpaceX remains a private company, Baron anticipates it will go public and list on a stock exchange within the next three years. He invested approximately $700 million in SpaceX a few years ago, and a recent secondary share sale suggested a valuation of nearly $150 billion for the entire company.

Baron envisions SpaceX's value reaching around $500 to $600 billion by 2030, with the potential for substantial growth in the subsequent decades. He believes that SpaceX could surpass Tesla's prominence by the 2030s.

Baron highlights SpaceX's satellite-Internet business as a game-changer, referring to it as "Internet for the planet." He predicts that SpaceX will offer substantially lower-cost Internet services in many areas compared to any competitors.

Regarding the risk of such substantial investments centered on one individual, Baron acknowledges that this risk was more significant when both Tesla and SpaceX were smaller companies with fewer personnel, making them more dependent on Musk. However, he emphasizes that these companies now boast numerous talented professionals and engineers, with an astounding 3.5 million job applicants for positions at Tesla and SpaceX in the past year. He describes the workforce as "the most brilliant people," suggesting that this won't change.

Yet, Baron acknowledges that Musk is a unique and irreplaceable force. While the future is uncertain, Baron's bet is that Musk will continue to be a driving force for at least the next 5 to 10 years.